If you are currently in the very uncomfortable position of not being able to pay all your bills on time, here’s how to get through this valley with the least amount of pain and scarring,

Do not allow the current situation to redefine who you are.

You are a person of integrity. Your word means something; you take care of your family; you honor your commitments. This doesn’t mean that you never stumble or lose your way. It does mean that when you do fall short of your own expectations you change course and re-commit.

Protect your relationships and rely on your faith during this rough spot.

Take Responsibility

If they hadn’t cut your bonus, eliminated your job, if housing prices hadn’t crashed, if you mother hadn’t gotten ill…. you would not be here. But it happened and you are – so start right here today with where you are. You made a promise you cannot keep and now you need to get to control over the situation.

Make a Realistic Plan

Winning the lotto, scoring a new job that pays twice what the old one does, or selling your car for twice what it’s worth, are examples of events that are not likely to happen.

You need to create a Crisis Spending Plan based on your actual income.

Develop your plan starting with basic food – no restaurants, no fast food, no steaks, no beer, just beans & rice, mac & cheese, PB&J; cut the budget to the bone.

Next you need to pay your utilities, water, electric, gas, not cable not internet. If the utilities are behind, catch them up before doing anything else.

Shelter is our next priority. Pay your rent or your mortgage.

Finally, secure your transportation. Make your car payment; get your bus pass; set your gas money aside.

Now that you have your four walls (food, utilities, shelter, and transportation) in place, you can start your battle against your debt.

Who Gets Paid?

Make a list of all of those you owe; how much you owe them and how far behind you are.

If you can’t make the minimum payments on all your debts, you may choose to pay them each their pro-rated share of the money you do have available.

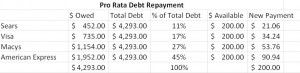

List each debt. Divide each debt by the total debt to get the debts percentage of the total. Multiply each percent by amount of money you have available to pay debt. This will give you your new payment. Send a copy of your worksheet with each payment.

Like this:

Contact your Creditors

Some creditors will be much more willing to work with you if you can state your hardship case and your plan for overcoming it. Some won’t. Typically credit card companies, big banks and Sallie Mae don’t care about your problems and will treat you in whatever way they think is most likely to get them a payment. They may appear to be warm and understanding today and then become belligerent and abusive tomorrow.

If you owe money to local businesses or individuals, you may be able to negotiate a payment plan.

As much for yourself as for the creditor, always communicate honestly with the creditor. Calmly tell them why you haven’t paid, when you expect to send them some money and how much it will be. Send them a copy of your pro rata worksheet with any payment that is less than the minimum.

When Sears calls about the past due payment on your credit card, your side of the conversation could sound like this:

Yes, I’m aware that the payment is late. My hours have been cut at work and we are unable to pay all our bills. When I am paid next Friday, we will be sending you $21.06.

No matter what they say, you stay calm and repeat that’s all your able to do. Keep your four walls in place and do not put your family in jeopardy because of some collectors ranting. Never give them electronic access to your accounts.

Once you have a written plan in place – follow it.