In the world I grew up in there were two kinds of debt, good and bad.

Good debt was debt used to buy things that are going up in value, real estate, home improvement or education.

Bad debt was debt for depreciating stuff like clothes, vacations, dinners out etc.

Cars, even though they depreciate like crazy, got a pass and were ruled ok debt.

This is no longer that world.

In today’s world there is Bad Debt and Worse Debt and Toxic Debt.

Bad Debt is a 15 year fixed rate mortgage on a home that the payments are no more than 25% of your take home pay. How can this possibly be bad? It is debt. It has risk. It costs you money in the form of interest. It is as close to being “good” as a debt can get but let’s call it bad to remind us we want out of it as soon as possible.

Worse Debt is secured debt on rapidly depreciating cars, boats and other toys. In the old world, advisors would say a car loan was fine if paying cash would wipe out your reserves; after all you need a car. Depending on where you live and what you do for a living you might convince me you need a car, but you will have a very hard time convincing me you need a car loan. Buy a car you can afford. Can’t pay cash for a new car? Guess you don’t get a new car. Can’t pay cash for a 5 year old car? Try an 8 year old car. Maybe you really have to have a car loan but if so, it should be a very small loan on a used car and you need a plan to pay it off really fast.

Toxic Debt paying 12-25% interest on stuff that has virtually no resale value is financial suicide. You did not need the stuff in the first place. If you carry a balance on your credit card it proves you could not afford the stuff. Don’t buy stuff unless you can pay for it.

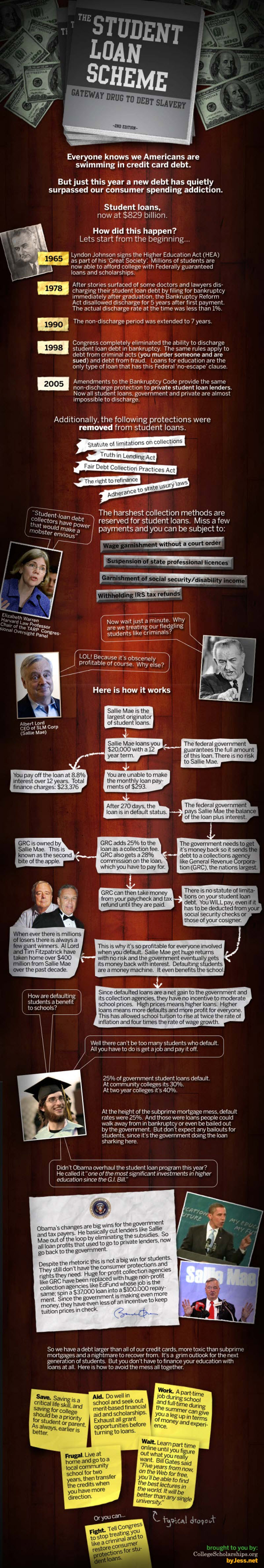

Another form of Toxic debt is the school loan. This is new world. The price of tuition has gotten so high and the lure of easy loans is so strong that many graduate with huge loans that are totally out of line with their probable earnings.

The Financial Aid Officer sitting across the desk from you is the devil incarnate. You are selling your future. Be very, very, very careful.

Wake up! If you have been living by the rules you were taught and you’re not winning, it’s because the world has changed.

There is no good debt and right now is a great time to assess how you can adapt and win.