Yesterday, we looked at Dave Ramsey’s 7 baby steps; these are steps almost everyone can follow. If you have an income, a reasonable level of commitment and some patience, you can make some real progress at becoming financially secure.

So what if you really want to go crazy with this thing? If you have a very early retirement as your goal, you might want to read what Jacob Lund Fisker has to say. Mr. Fisker has a 21 day makeover plan to get you on the path to save 75% of your income and retire extremely early. This guy is really smart. His is also way out under the long tail of our graph.

If you are willing to start questioning why we live they way we do; try:

The forest versus the trees Early Retirement Extreme: — written by Jacob Lund Fisker

In this blog Fisker explains how the actions of his deliberate and planned frugality interact.

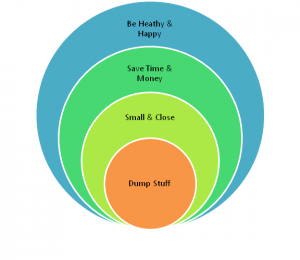

Dump Stuff is a suggestion that Fiske makes early in his 21 day plan. He contends that a too big, too expensive house or apartment is one thing holding people back from achieving their goals. People buy or rent too much home so they have a place to put their stuff.

Small & Close are the words to have in mind when looking for a place to live.

Save Time & Money – Live close to work, recreation and shopping. You will save time and money on your commute and may be able to get down to one, or no cars.

Be Happy & Healthy – Walk or bike that commute to decrease your stress and improve your health. Spend some of that saved commute time cooking healthy real food.

Each of these actions has a benefit by themselves, but done together a real money saving synergy is created.

If we look at the opposite of the life he describes, we have a huge house in the suburbs, where no one can walk to anything.

Both parents must work to pay the mortgage, insurance, taxes and upkeep of our big house.

Commute times and costs are so high that three nights a week dinner is from a drive through.

The kids spend more time in the car shuttling from school to activity than they do playing outside.

At night the family zones out in front of their 52 inch 212 channel TV. No one has time to nurture relationships and everyone’s health suffers from lack of exercise, stress and poor diet.

How about that, we started off trying to save your money and instead we might just save your life.