Change is possible and it doesn’t have to be a knockdown slugfest. Patience and kindness have been scientifically proven to extend the stamina of our woefully out-muscled willpower. Tiny steps, fast wins and environmental tweaks can make a seemingly impossible change happen almost painlessly.

Most of us, who have tried to cut back on spending, either to pay off debt or increase our savings, think we have a money problem. We don’t. We have a behavior problem. Our spending habits are based on the same neurological loop that is at the core of all habits.

We have been generously rewarded hundreds or thousands of times for the very behavior that we now need to change. That fact, all by itself, will make long-term change hard unless we carefully plan the change using everything we know about habits and behavior. No matter how smart or how disciplined we think we are, none of us can easily force ourselves to do what we know we should do long-term, if it is contrary to our established habits.

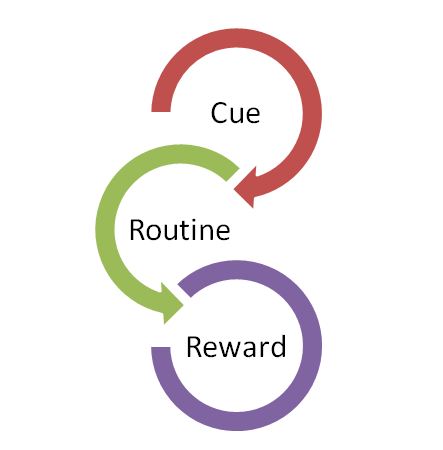

One great way to change habits is to leave the cue and reward in place but change the routine. Let’s say you normally head for the corner pub on Friday evening after work to meet a friend. A drink and an appetizer later you’ve easily spent $20 not to mention a ton of empty calories. The cue is 5 o’clock on Friday; the reward is the relaxing social time with a friend. If we change the routine from meeting at the pub to meeting at the park for a stroll, leaving both the cue and the reward in place, this habit will be easier to change.

The challenge is to carefully and mindfully dissect your problem behaviors in order to determine what the cue, the routine and the reward truly are and then finding a replacement routine.

Another great strategy that you must employ if you want to painlessly produce big behavior changes is teeny tiny steps. As a Dave Ramsey trained coach, I fully endorse the use of Ramsey 7 baby steps but most of those baby steps are huge giant leaps compared to the teeny tiny steps I’m referring to. Much of the magic of Ramsey’s plan is found in Step 2, the debt snowball. The debt snowball for most families does use tiny steps allowing for some fast wins and helping change behavior. But what if you have no small debts? I see this problem frequently. If the very smallest debt you have is going to take seemingly forever to pay off, it is easy to become discouraged and quit.

We must find a teeny tiny step that you can successfully accomplish. Maybe we start with just tracking your spending using Mint.com No shame, no blame, no changes required, let’s just see where we are. Or maybe we can start with no restaurant spending for lunch for today? Can you do that, not eat out for lunch, just for today? It absolutely does not matter that neither of these behaviors will pay down that huge debt, it only matters that you can and will do them. With patience, we can build a staircase of teeny tiny steps that will lead you to your goal.